“Behind every Stock Index there’s a

dragon waiting to be unleashed!”

Trading the stock indices is like having a pet dragon;

when you attempt to put it on a “leash”, it gets pissed off and does what it

wants anyway. So goes the current state of the U.S. markets, where everybody

and there brother is bearish, pumping out articles and posts of “imminent

crashes”, doom & gloom reports, fake earnings, fake accounting, and only

the “dumbest of the dumb” would be long the indices.

Then you look at the prices and realize that the

Dow30, at roughly 20950, is about 1% and change from all time record highs, set

on March 1, 2017. “Ok pet dragon, I want

you to come over here and go this way … No? … I said go this way … wait, what?

… why are you dragging me the other way”? Now, this doesn’t mean prices

can’t go down … she’s a fickle pet … it simply means the “big one” isn’t

anywhere in sight. “Go ahead, be the next

brave soul on “the street” to sell everything, go short, buck the FED planners,

take on the corporate buyback schemes so much in vogue in corporate America,

and then tackle the “Plunge Protection Team” IF prices start falling; at some

point you have to get out, and when you do, your pet dragon will be there to

inflict more pain on you than you can imagine. And if you don’t believe me, go

ask the “wizards” who sold with abandon on the night of President Trump’s

election victory; ask them how that worked out”.

Again today, for the umpteenth billionth time, ZH has

got a slew of articles pointing the way to financial Armageddon just around the

corner; only problem is the same guys have been saying this for years, decades,

most likely before most of you were born. Sure, at some point in the future

there will be a wicked bear market in the stock indices … it comes when it comes,

and no amount of “economic and/or financial chart porn” is gonna change that.

Been there, done that, seen that, heard that … and all it ever does is go up!

So unless something happens that threatens the further

ability of the U.S. economy to grow, corporate earnings to grow, and changes

the “mindset” of the people investing, those old enough to remember will simply

hold through the fundamental rough patches and wait it out … they ain’t gonna

sell unless they are convinced the “system” has been threatened. In fact, they

will continue to buy dips … “alas, the

BTFD folks who are derided every day by “smart” money, but whose track record

proves they are right, up & until something proves them wrong.” … add

money to their 401(k)’s, buy more ETF’s and index funds, and treat stocks like

Apple & Amazon like religions that can’t ever be abandoned. And it will

drive many traders to a rubber room, cuz they can’t take the perceived

stupidity!

In a normal world, if I was a disinterested party in

the stock indices, I’d make my case with facts at my disposal and then rest;

but that’s NOT what we see on forums like ZH, where bearish articles have taken

on a zeal & righteousness bordering on “hyper inflated paranoia” by those

who either are short or have a vested interest in seeing prices go down. “Nothing ever changes; talking heads gotta

talk, and analysts got to promote their firm’s recommendations. Nobody at the

table brings clean hands.” Keep this in mind next time you hear the sky is

falling.

Turning to today’s market … again very quiet overnight

in Asia & Europe … very small ranges in everything traded … today starts

the FED’s May meeting, which culminates in an interest rate decision tomorrow

at 2 P.M. EDST, and then on Friday we get the most important jobs number evahhhh from the Department of Unicorns

& Fairy Tales. ADP also reports on private sector employment tomorrow

morning @ 8:15 EDST as well, with the last few months’ numbers moving the

markets substantially. Maybe we’re on “hold” until then … you know the drill … “Hurry up & wait”… we’ll see, but

again, we continue to hang up here in the SP500 between 2385 – 2395, and are

within easy striking distance of breaking through 2400 – 2402; if that gives

way it’s gonna be a complete clusterfark on the way up.

Here at the New York open, some light buying interest

… that gives way to more “loose lips sink ships” talk from President Trump,

which promptly sees the Dow30 go down 20 points in under a minute cuz “we need

a good gov’t shutdown in September to fix this mess” [meaning the budget]. “May you live in interesting times”!

New low for the day saw a bullish engulfing pattern on

the M1; after 9 minutes it’s unchanged, but range for the day is still way to

low to pick bottoms this close to the open aqua line. SP500 is stubbornly

hanging onto the 2390 handle, but really needs to see sub 2385 to flush out

sell stops; that more than likely will be a good long point.

And @ 14:44 it’s one of those, “hey, the Dukes know something … let’s get in on this”! Only the

Dukes don’t know squat, cuz that 20 point Dow30 rally in 2 minutes out of

nowhere, went exactly nowhere, and 30 minutes later the market is right back

from where it started [drip, drip, drip right back down]… I can’t begin to

describe how pitiful trading conditions have become … and it ain’t only in the

stock indices … everything traded across the board just sitting; doing nothing

with ranges for the day you can barely see on a daily chart … I realize we got

ADP employment tomorrow morning, the FED in the afternoon at 2 P.M., and NFP on

Friday, but this is ridiculous.

Well, about time; somebody somewhere got an opinion

and shoved the Dow30 through the New

York open, and that produced my first trade of the

day. Of course, once it got through there it couldn’t do “Mr. Jack Squat”, so I

liquidated on a failure to break to a new high; directly below the trade.

Yesterday, I was having problems with my image copy

software “Snagit”; it would let me copy my chart screens, but it wouldn’t let

me save it to file as a jpeg or png file. So, last night after my tubby, and me

and the dog got settled in the study while the Mrs. watched Caribbean soap

operas on TV [don’t go there, Ok?], I reinstalled “Snagit” and today it works

fine. So, problem solved.

I have said before, “doji’s”, when they start showing

up on the daily charts, have a nasty habit of clustering; meaning of course

multiple days in a row or something like 3 out of 4. Once again today, we get

the “Flying Wedge of Death” with Doji action; open, go down, go up to open, go

make a new low, and off of that new low rocket straight up through the open and

… do absolutely nothing but drift and then start the slow move lower. In case

you were wondering, got caught in this crap yesterday, and seeing the market

fail up at the high, I didn’t hesitate in liquidating.

In the last 27 years, going back to 1990, we’ve only

seen the VIX close below 10 three times; yesterday it closed at 10.11, and I’m

betting if things don’t improve by the close, we’ll see a close with a “9”

handle; that’s how bad things have

gotten. One other thing caught my eye this morning; if you strip out the

French election open on Sunday night and the following Tuesday before the open

melt up, and the Easter Monday quasi Holiday melt up, the Dow30 has only been higher 4 times [out of 21 market days] in the

New York session from the New York open. And only one of those days … exactly one … was there any gain of

significance; the rest of the time it’s been grudgingly lower with very sharp

rallies that fizzle out as fast as they start.

Which brings me to my next point; namely, for those of

you who haven’t been around this biz very long [less than 10 years], bear

markets produce some of the strongest bull market days ever seen in stock

indices market history. You’ll have completely insane melt ups that will

convince 99.99% of all traders that the “bear” is dead and a new bull market is

beginning; not the case, cuz what happens after that blow off day up is the

market starts to drift lower and within a week or two completely takes out the

range of that melt up day and shreds it to pieces. This produces another wave

of selling, and the process rinses & repeats, and starts over until the

end.

Bull markets, on the other hand usually don’t melt up;

instead it’s a steady climb up the “wall of worry”, until shorts can’t take it

anymore and throw in the proverbial towel and the market spurts up. It’s that

slower action that gives the shorts “hope” to stay in losing positions that

makes it so tough to stick with long positions.

Now, take a look at what’s been happening in the indices

lately, and you tell me; “what kind of

action are we seeing now”? To me, it looks very much like bear market

action in the Dow30 over the last month or so; and yet, here we are sitting

with the VIX in single digits and the market within about 1% of its all time

high. And if you’re wondering, this is why a substantial proportion of the

investors out there are confused as hell and why the action lately has a lot of

them dumbfounded. “Speed of light trading … then

crickets”! isn’t something anybody figured could happen, and adjusting to

this has been rough for many investors; especially hedge funds, who continue to

go out of business faster than Pols cash campaign donation checks.

Half hour from the close … well, here we are again …

another day of “WTF was that”? imitation

version of a trading day. Unless you were watching this in real time, it’s hard

for me to explain how pathetic this day was; hopefully with ADP & the FED

tomorrow, the market can get a healthy range back, and along with it some

trades that matter and produce some good profits. We’ll see what happens

tomorrow.

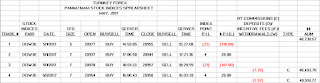

PAMM/MAM spreadsheet directly below.

Ok, time to hit the beach … I’m outta here … until

tomorrow.

Have a great day everybody!

-vegas

OUR ‘TURNKEY FOREX’

PAMM/MAM IS NOW OPEN AND

OPERATIONAL; SEE “PAMM/MAM MANAGED MONEY PROGRAM” IN “DOWNLOAD LINKS” SECTION

IN RIGHT HAND COLUMN FOR DETAILS [VIEW ONLINE AND/OR DOWNLOAD] AND START YOUR

JOURNEY FROM WHERE YOU ARE AT TO “ESCAPE

TO SUCCESS”!

No comments:

Post a Comment