“I desire the proof of

the negative that can’t happen!”

The

Version 4 Algorithm “Quick Guide” is out and available, and while very brief

and concise, there are 2 important criteria I want to bring up; 1) the reason

it works and is powerful, is that it pinpoints the end of the corrective phase

inside a contra short term trend, and 2) it first waits for the “trend

followers” and moving average folks to “puke” and liquidate, and then on the

turn makes the call for a position; it simply uses the M1 against all those

using it for trend and “fades it” at the turn. So, in essence, the algorithm waits

for and wants the Moving Average [MA] folks using the M1 for signals to

liquidate on a trend change that is 1) the least effective of all time frames

and highly unreliable, and 2) takes the appropriate opposite position.

As

I have written before, there are “non-computable” problems in trading that

computers can’t solve; so, if for example, I tried to “code” this Version 4

algorithm into an EA [Expert Advisor], how do you define “at the turn”? Exactly

what is it? An engulfing pattern, a reversal, simply a color change, what? And

here is where the problems mount exponentially, cuz if you don’t “act” in a

literal second, the trade more than likely will be gone … there is “zero” time

for you to analyze the setup and make a decision … which of course can lead to

paralysis and that’s not good either.

Now,

we all know that there is absolutely nothing in the trading financial realm

that is 100% guaranteed; always have and always will be dealing in “probability

waves”. Over time, everything will happen, you just have to wait long enough to

see it. Having said that, in the “Quick Guide” I mentioned the algorithm’s

limitations, one of which is that when the M5 changes trend, and goes from one

side of the “Kumo Cloud” to the other, the position has a much higher

probability of loss than at other times. But, inside the short-term trend, it

gives some great turning points … some give the signals from the Version 3.2

algorithm, but whether they are present or not, if the M5 doesn’t change trend,

the M1 signal trade will be a good one from a profit perspective.

What

I’ve done, essentially, is turn the market on its donkey and ask it to prove me

wrong; I’m not asking for a continuation of a “breakout” trend on the M1 “Kumo

Cloud”, or try and follow any breakout of the traditional MA’s (2) that come

with the indicator on the MT4, that says to the market, “can you please continue a little further so I can profit”? With

probabilities greater than a casino in Las Vegas enjoys, I know what the answer

is … to ask the question is to answer it!

It

all starts with, “tell me what you can’t

do with ease? … what’s hard for you Mr. Market? … what and where is the highest

probability event inside a short-term trend to make a trade and profit? … and

what is it approximately”? And the answer is, all of the “fake out” breakouts on the

Ichimoku MA’s, the “Kumo Cloud”, and by default the other indicators that follow

right along and get people to make the wrong trade [e.g., MACD, RSI, etc.], cuz

what’s happening in real time is that the “big money” has the time, money, and computer

capability to know with certainty what the top 500 trading systems are doing in

real time, and the software “know how” to exploit traders without the trader

ever knowing he/she is being exploited by a large hedge fund or bank. [“What, you expected them to tell you first”?]

And

as we find ourselves [without anybody’s permission of course] in the “Central

Bank Paradigm” of trading now, the first question every trader should be asking

themselves is, “why has trading changed

and what can I do about it”? … but instead ask, “things have changed but I don’t know why … should I be worried about

it, or just trust the market? So, the Version 4 algorithm started out in

its genesis, not with “help me with better trend following signals Mr. Market”,

but with “show me … Mr. Market … what’s the most difficult thing for you to do

to NOT screw people, the least amount of the time”. Cuz when I know that, or

have a good idea of what it is, I can do the “OPPOSITE” and achieve consistent

success and profit.

And

really, that’s what lies at the philosophical heart of the Version 4 Algorithm

and how it is different than previous versions. Once I realized I didn’t have

to “reinvent the wheel”, and that the math was available inside the “Ichimoku

Kinko Hyo” indicator on the MT4, and that I could pick apart what I wanted and

discard the rest, things fell into place rather quickly.

Turning

to today’s market … “vapors” anyone? … seriously, I’m getting more than a

little annoyed with the Dow30 showing every single damn day that basically,

about 99% of every rally happens away from New York, when the market is easily

manipulated when everybody is asleep. Then, New York is a simple “protect &

defend” the manipulations higher, but no more … the action is disgusting, the

volumes pitiful, and the ranges along with volatility [VIX] the worst in 50+

years.

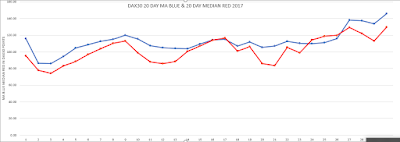

The

DAX30, on the other hand, exhibiting what a semi-free stock index market looks

like when allowed to go up and down. Not the best of days, as the market has

put in a solid reversal to the downside, inside a somewhat small range… going

in and out of the M5 “Kumo Cloud” twice with a short term trend change. A

little unusual, as reversals of this magnitude are somewhat rare in stock

indices [approximately 3% - 5% probability on any given day], but certainly not

a “one off” like a “double reversal” which are extremely rare and happen once

every 5 – 10 years.

In

total, I made 3 DAX30 trades today for the PAMM [yes, the Excel spreadsheet is

working now], 2 from the long side and 1 from the short side; on the second

long trade, the market trapped us with a “twofer”; 1) price on the M5 went into

the “Kumo cloud” thus going from bullish to neutral, and 2) price slowly

drifting away from my entry point on the M1 … in sum, took a small loss and

moved on. The other long trade and the short sale played out very well, so it’s

a profitable day … not as much as I’d like, but the fact is the cash market in

the DAX30 opened today and went straight up … after its high, its straight down

to new lows … even the M1 spent an enormous amount of time over, and then

under, its “Kumo Cloud”, and therefore there were only a few signals generated

before the cash close at 11:30; smaller than most days to be sure.

The

Dow30? … I’ve run out of adjectives to describe the trading action … it’s

simply “nonexistent”, and it’s pointless to mention what’s going on, cuz

nothing is going on that is worth repeating in front of children … leaving it

alone until something / anything happens that can get an M1 > than 3 – 5 points!

… I’m not sure there aren’t 15 minute intervals where you can’t even get

outside the 2 point spread … and the SP500? … worse than the Dow30, and to be

totally honest, I don’t know how anybody can be expected to trade this puppy it’s

so sickly. Two great markets placed into utter obscurity by central bank

manipulators hellbent on using the stock market as a social policy tool … the

utter hubris and pomp they place on themselves, that history may show them soon

what total fools they really are in retrospect.

Well,

here we are about 30 minutes from the close in New York, and it has been truly

one of those days in the Dow30 & SP500 you can forget and file under “waste

of time”. I don’t know how much worse the price action can get … it’s simply unbelievable

how pitiful conditions have become, especially when you realize that outside of

less than a handful of days, since April which is 4 months, practically every

day the Dow30 is higher comes from overnight “vapors” … New York is a disaster,

pretty much a nothing burger with more movement in the DAX30 when it is closed,

than the Dow30 when it’s open. But, here we are, and this historically low VIX

[50 + year lows, and an all-time record low the other day at 8.63; something

the market has never seen … ever.] has people lulled to sleep with complacency

and risk, so over loaded on the hype the FED “has their back” … “hi, I’m from the government and I’m here to

help”! Onward & Upward!

PAMM

spreadsheet directly below.

Time

for the beach! … “the ice cream King” and I are outta here … until tomorrow.

Have

a great day everybody!

-vegas

OUR TURNKEY FOREX “PAMM/MAM” IS NOW

OPEN AND OPERATIONAL; SEE “PAMM/MAM MANAGED MONEY PROGRAM” IN “DOWNLOAD LINKS”

SECTION IN RIGHT HAND COLUMN FOR DETAILS [VIEW ONLINE AND/OR DOWNLOAD] AND

START YOUR JOURNEY FROM WHERE YOU ARE AT TO “ESCAPE

TO SUCCESS”!