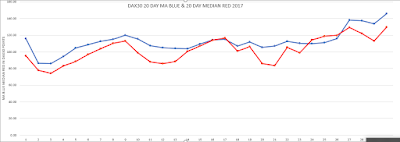

2017

PLOT OF DAX30 RANGES 20 DAY MA [BLUE[ VS 20 DAY MEDIAN [RED] [Click on chart to enlarge]

Directly

above is a line chart, from the start of 2017 to present, that shows the

average 20 day simple MA [moving average] in blue, versus the average 20 day

simple MEDIAN in red for the following week in the DAX30. The blue line is the “simple

average” of the last 20 days ranges for each day; the red line is the MEDIAN

[meaning the 50% value of 10 days above and 10 days below] of the last 20 days

ranges.

When

the BLUE LINE IS OVER THE RED LINE, it means there are some outlier large

ranges [up/down doesn’t matter] in the last 20 days that were well above

average for the series, and tends to skew the data higher. WHEN THE BLUE LINE

IS UNDER THE RED LINE, it means there were some abnormally “low range” days

that skewed the data for the series lower. And finally, when both lines are

relatively equal, the data is consistent for the last 20 days and most days

fall relatively close to the average and median; in other words, no outlier

days.

What

this gives you is a very good “snapshot” of intraday volatility in the DAX30,

and whether it is increasing, going down, or relatively stable in terms of expected

ranges each week. You can tell from the above graph, for example, that at the

start of the year intraday volatility dropped, as that data is dependent on

data from December and the Holiday’s, where ranges can be very low. In

addition, we also had a drop during the period surrounding the Dutch and French

elections, as uncertainty gripped Europe and stock traders and investors backed

away. You can also see, that right now we are at the highest levels of intraday

volatility of 2017.

From

now on, on Sunday, I’ll post the chart for the UPCOMING WEEK, and give the raw

data for the year in table form directly below it, so you can see the actual

values for each week of the year. For each date and corresponding value, it

means for example, that for the upcoming week of July 24th that

starts Monday [tomorrow], you would use either or both of the values in your

trading for each day of this week. Next weekend, I’ll post a new chart with new

values for that upcoming week. Directly below the tables of the raw data for

the DAX30.

[CONTINUED]

The

complete “-vegas Version 4 Volatility Algorithm” is a long document, and it’s

taking me longer than I had originally anticipated to finish it. Once I started

writing it, I quickly realized that “what I know” isn’t what you or trading

Newbies know, and that I had to make a greater effort to explain things in

simple English, along with more examples than ever before. Therefore, it’s

taking me some time, and it looks as though it may be a few weeks yet before I’m

happy with it and it’s released here on the website.

I’ve

decided, that what’s needed is a “quick guide” to the version 4 algo, and to

that end, next weekend I’ll have a very brief summary available for viewing

online or download [Over in the “Download Links” section in the right hand

column], that is only a few pages long yet gives a summary of the algorithm

rules, how to apply them and trade the DAX30 and/or the Dow30. This will get

all of you going, as well as give me some time to finish the big enchilada without

worrying about time constraints or rushing to finish and forgetting something.

Have

a great rest of your weekend everybody!

-vegas

OUR TURNKEY FOREX “PAMM/MAM” IS NOW

OPEN AND OPERATIONAL; SEE “PAMM/MAM MANAGED MONEY PROGRAM” IN “DOWNLOAD LINKS”

SECTION IN RIGHT HAND COLUMN FOR DETAILS [VIEW ONLINE AND/OR DOWNLOAD] AND

START YOUR JOURNEY FROM WHERE YOU ARE AT TO “ESCAPE

TO SUCCESS”!

No comments:

Post a Comment